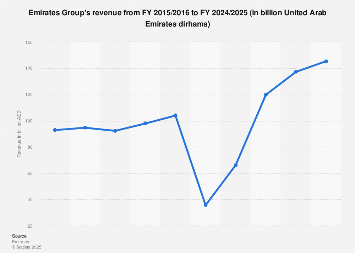

However, from mid-February things changed rapidly as the COVID-19 pandemic swept across the world, causing a sudden and tremendous drop in demand for international air travel as countries closed their borders and imposed stringent travel restrictions. His Highness Sheikh Ahmed bin Saeed Al Maktoum, Chairman and Chief Executive, Emirates Airline and Group, said: “For the first 11 months of 2019-20, Emirates and dnata were performing strongly, and we were on track to deliver against our business targets. The Group’s cash balance was AED 25.6 billion (US$ 7.0 billion), up 15% from last year mainly due to a strong business performance up to February 2020 and lower fuel cost compared to previous year.ĭue to the unprecedented business environment from the ongoing pandemic, and to protect the Group’s liquidity position, the Group has not declared a dividend for this financial year after last year’s dividend of AED 500 million (US$ 136 million) to the Investment Corporation of Dubai. The Group’s revenue reached AED 104.0 billion (US$ 28.3 billion), a decline of 5% over last year’s results.

Released today in its 2019-20 Annual Report, the Emirates Group posted a profit of AED 1.7 billion (US$ 456 million) for the financial year ended 31 March 2020, down 28% from last year.

Revenue declines by 6% to AED 92.0 billion (US$ 25.1 billion), impacted by planned 45 days DXB runway closure and temporary suspension of passenger flights in March.Ends year with solid cash balance of AED 25.6 billion (US$ 7.0 billion)Įmirates reports a profit of AED 1.1 billion (US$ 288 million), 21% up from the previous year.Group revenue of AED 104 billion (US$ 28.3 billion) impacted by planned Dubai International airport (DXB) runway closure in Q1 and COVID-19 pandemic in Q4.Group records 32 nd consecutive year of profit of AED 1.7 billion (US$ 456 million)

0 kommentar(er)

0 kommentar(er)